Capital ExpensesĬapital expenses are costs related to purchasing assets that have a useful life beyond the current tax year, such as machinery, equipment, and property. It’s important to note that a business expense must not be indispensable to be considered necessary. When calculating taxable income, these expenses may be deducted from your business’s income. In business expenses, the term “ordinary and necessary” refers to expenses that are common and accepted in the trade or business and are helpful and appropriate for the business. These expenses are fully deductible in the tax year they occur. Operating expenses are ordinary and necessary costs they are the day-to-day costs incurred in running a business. Business expenses can be broadly categorized into two types: operating expenses and capital expenses. Understanding the different types of business expenses is crucial for effective business management and tax planning.

#DEDUCTIBLE BUSINESS EXPENSES SOFTWARE#

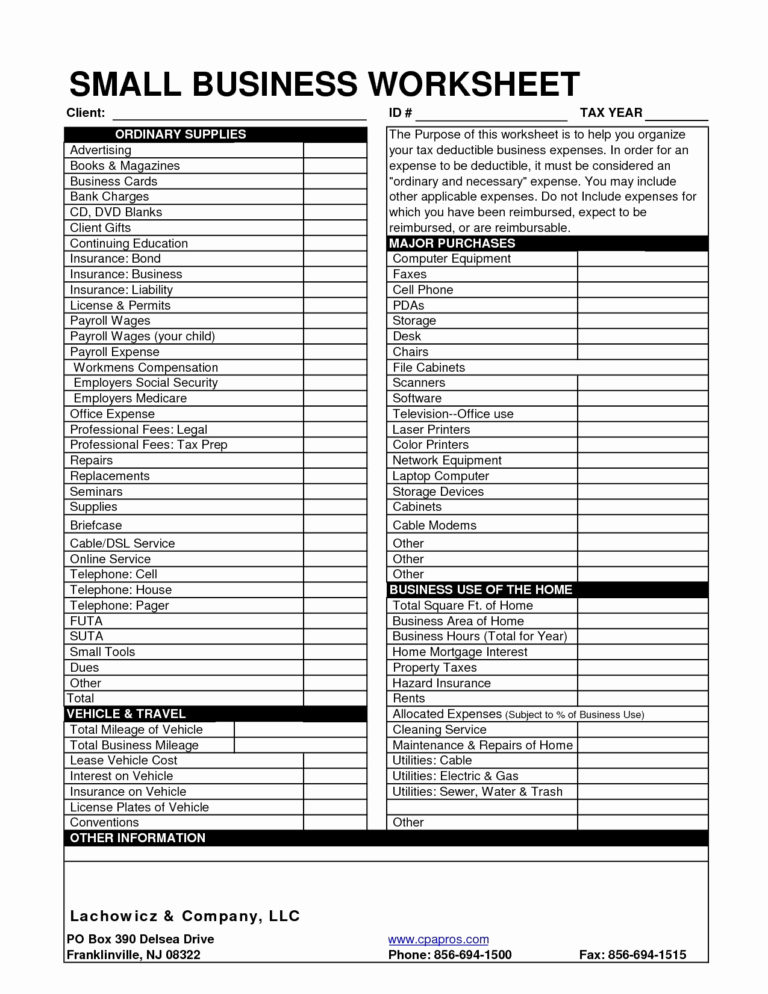

Additionally, business accounting software can assist in tracking business expenses, ensuring that personal and business expenses are clearly distinguished. Using a business checking account separate from a personal account can help track business expenses more effectively. In such cases, it’s crucial to accurately calculate and record the business portion of these expenses. Most business owners operate a business from home during the initial phase a portion of home expenses can be classified as business expenses. For example, if a small business owner uses his personal car for business purposes, a portion of the vehicle expenses can be considered business expenses. There are instances where personal and business expenses can overlap. These expenses are tax deductible, reducing taxable income and, consequently, reducing the overall tax bill. While these expenses are necessary for personal life, they are not tax-deductible, and the business owner must not claim personal expenses.īusiness expenses are the costs directly associated with running a business, for example, office rent, salaries, marketing costs, and office supplies. Personal expense lists include home mortgage or rent, personal vehicle expenses, groceries, and personal entertainment. Personal expenses are the costs incurred in daily life that are not directly related to the business operations. Difference between Personal and Business Expenses

#DEDUCTIBLE BUSINESS EXPENSES HOW TO#

Hence, understanding which expenses are deductible and how to properly track and record expenses is essential for maximizing tax savings. The Internal Revenue Service (IRS) stipulates that for a business expense to be deductible, it must be both “ordinary and necessary” for business operations. In the context of tax deductions, not all expenses qualify. By analyzing the types and amounts of expenses incurred, business owners can identify areas for cost reduction and allocate resources more efficiently. Understanding business expenses aids in strategic decision-making. This can lower tax liability, further enhancing the company’s bottom line. Many of these expenses are tax deductible, meaning they can be subtracted from a company’s gross income to reduce its taxable income. Secondly, business expenses play a pivotal role in tax calculations. Therefore, effective management of business expenses can lead to significant cost savings. The lower the expenses, the higher the potential profit. Tips for Effectively Tracking Business Expensesįirstly, business expenses directly impact a company’s profitability.Difference between Personal and Business Expenses.

0 kommentar(er)

0 kommentar(er)